Health Care, Politics, White House

Vice President Harris announces rules to improve staffing and care in nursing homes

Health Care, Politics, White House

Economy, Politics, White House

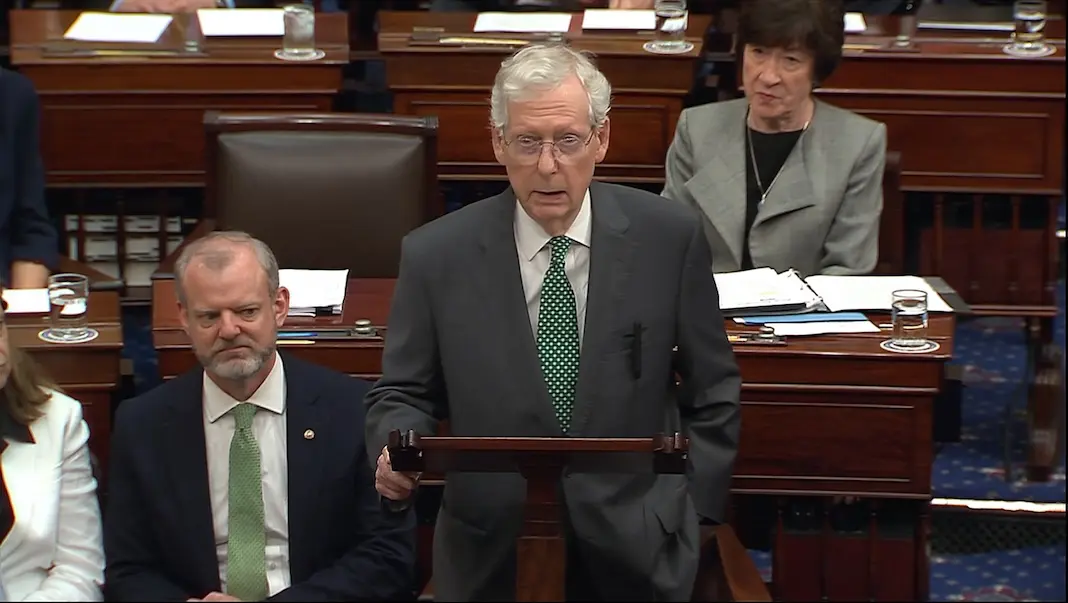

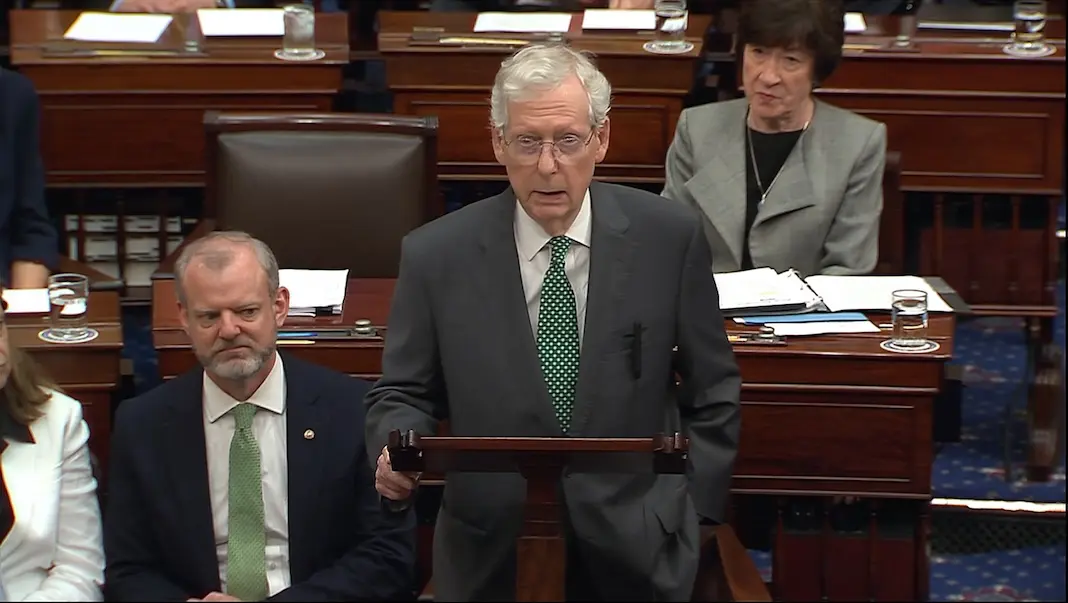

National, Politics, U.S. Senate

National, Politics, U.S. Senate

Environment, infrastructure, Local

Elections, Politics, U.S. Senate