Elections, Politics, U.S. House, U.S. Senate

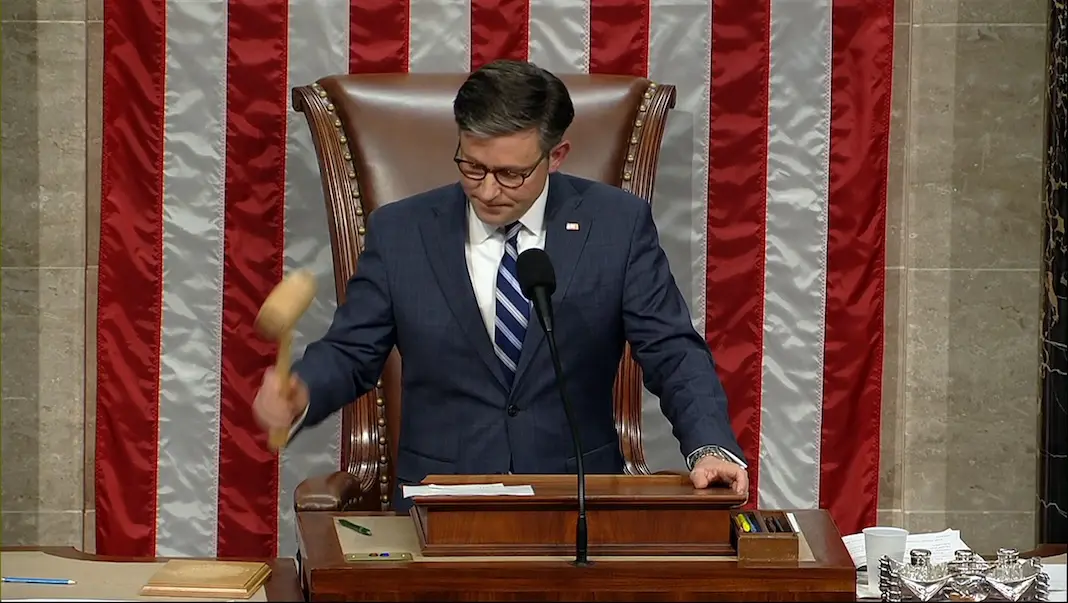

After rushing to impeach Mayorkas, House Republicans delay sending articles to Senate

Elections, Politics, U.S. House, U.S. Senate

Elections, Politics, U.S. House, U.S. Senate

Elections, Politics, U.S. House, U.S. Senate

Elections, Politics, U.S. House